trust capital gains tax rate uk

The trust deed defines income to include capital gains. 10 18 for residential property for your entire capital gain if your overall annual income is below 50270.

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work this out first 28.

. If a vulnerable beneficiary claim is made the trustees are taxed on. If you have a 500000 portfolio be prepared to have enough income for your retirement. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate.

Gains from selling other assets are charged at 10 for basic-rate taxpayers and 20 for higher-rate taxpayers. Trust Income Tax Rate up to 1000 Dividend-type income eg. In the UK Capital Gains Tax for residential property is charged at the rate of 28 where the total taxable gains and income are above the income tax basic rate band.

Bare Trust Income Tax Treatment. Trust income up to 1000. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Gains on the disposals of interests in residential property are upper rate gains. It also deals with. The following Capital Gains Tax rates apply.

HS294 Trusts and Capital Gains Tax 2020 Updated 6 April 2022. However if the settlor has set up 5 or more trusts the standard rate band for each trust is 200. 2022 Long-Term Capital Gains Trust Tax Rates.

State taxes are in addition to the above. It also deals with situations where a person disposes of an. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

For tax year 2019 the 20 rate applies to amounts above 12950. The tax rates are below. It continues to be important to obtain date of death values to support the step up in basis which will reduce the capital gains realized during the trust or estate administration.

Youll only need to pay these rates on the gains that exceed your capital gains allowance. The beneficiary of a bare trust has the responsibility for paying tax on the income earned from it. The tax rate on most net capital gain is no higher than 15 for most individuals.

Capital gains tax allowance. All other income 20. AEA is the tax-free allowance for the trust.

Capital gains are charged at a rate of 20 28 for residential property. Trustees may be able to reduce the rate of this tax if they qualify to claim Entrepreneurs Relief or Investors Relief. Capital gains tax is calculated using the same rules that apply to individuals but they typically only have half an individuals annual exemption.

6000 divided by the number of trusts settled subject to a minimum of 1200 per trust Capital gains tax rate. For the 20222023 tax year capital gains tax rates are. For example if your taxable income is 25000 and your overall capital gains after deduction of the tax-free allowance is 600 you would pay 60 capital gains tax 10 on your gain as your overall income is below.

Stocks and shares 75. Capital Gains Tax for trustees and personal representatives is charged at 20 per cent on gains that are not upper rate gains. For trusts in 2022 there are three long-term capital.

This means youll pay 30 in Capital Gains Tax. Further the rates of CGT payable by the Trustees are also the same. This helpsheet explains how United Kingdom UK resident trusts are treated for Capital Gains Tax CGT.

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. CGT allowance for 2022-23 and. Rates of tax.

Individuals have a 12300 capital gains tax allowance. 20 28 for residential property for your entire capital gain if your overall annual income is above the 50270 threshold. However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050.

875 on income in standard rate band 3935 dividend trust rate on income over standard rate band 0 875 3375 3935 Capital Gains Tax CGT Person liable for CGT on capital. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. In the United Kingdom the current tax-free allowance for a trust is.

Ad Download The 15-Minute Retirement Plan by Fisher Investments. A 28 per cent rate applies to upper rate gains. After you work out if you need to pay Capital Gains Tax is due if the total taxable gain is more than the Annual Exempt Amount eg.

If this amount places you within the basic-rate tax band you will pay 10 tax on any capital gains. Because the combined amount of 20300 is less than 37700 the basic rate band for the 2021 to 2022 tax year you pay Capital Gains Tax at 10. There is one significant difference and that is that Trustees are only entitled to a maximum of half the regular annual exemption that applies to individuals.

All other income 45. Trust capital gains computation. From 6 April 2016 trustees gains are taxed at 28 on residential property or 20 on other chargeable assets.

20 28 for residential property. Capital gains can arise in the trust on the disposal of trust assets or the appointment of assets to beneficiaries. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

Trust Income Tax Rate above 1000 Dividend-type income 381. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax. That capital gain is computed in much the same way as for an individual.

For higher-rate and additional-rate you will pay 20.

How Capital Gains Tax Works Moneyweek Investment Tutorials Youtube

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Difference Between Income Tax And Capital Gains Tax Difference Between

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Will Meet Fy20 Direct Tax Target Of Rs 11 7 Lakh Cr Mody Tax Debt Capital Gains Tax Filing Taxes

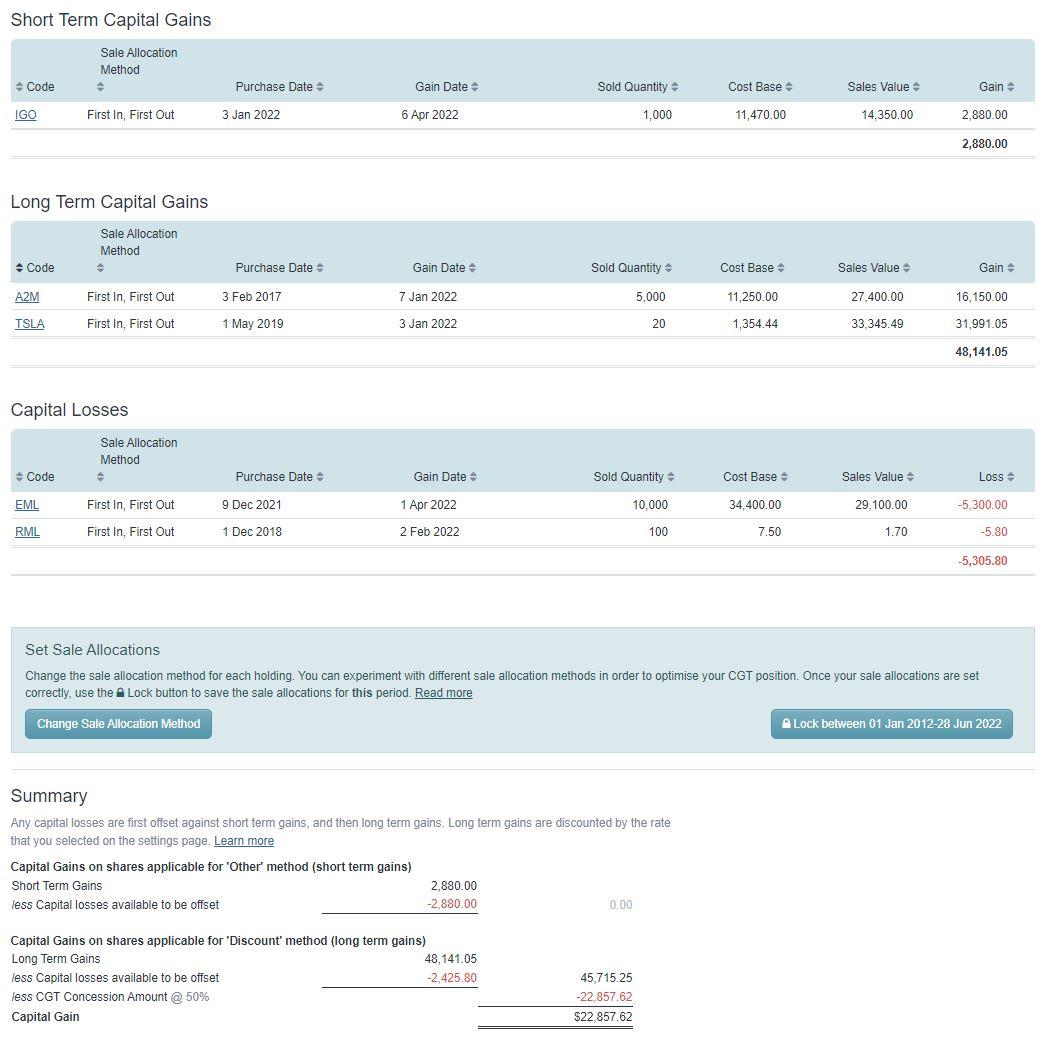

Capital Gains Tax Cgt Calculator For Australian Investors

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice

2021 Trust Tax Rates And Exemptions

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

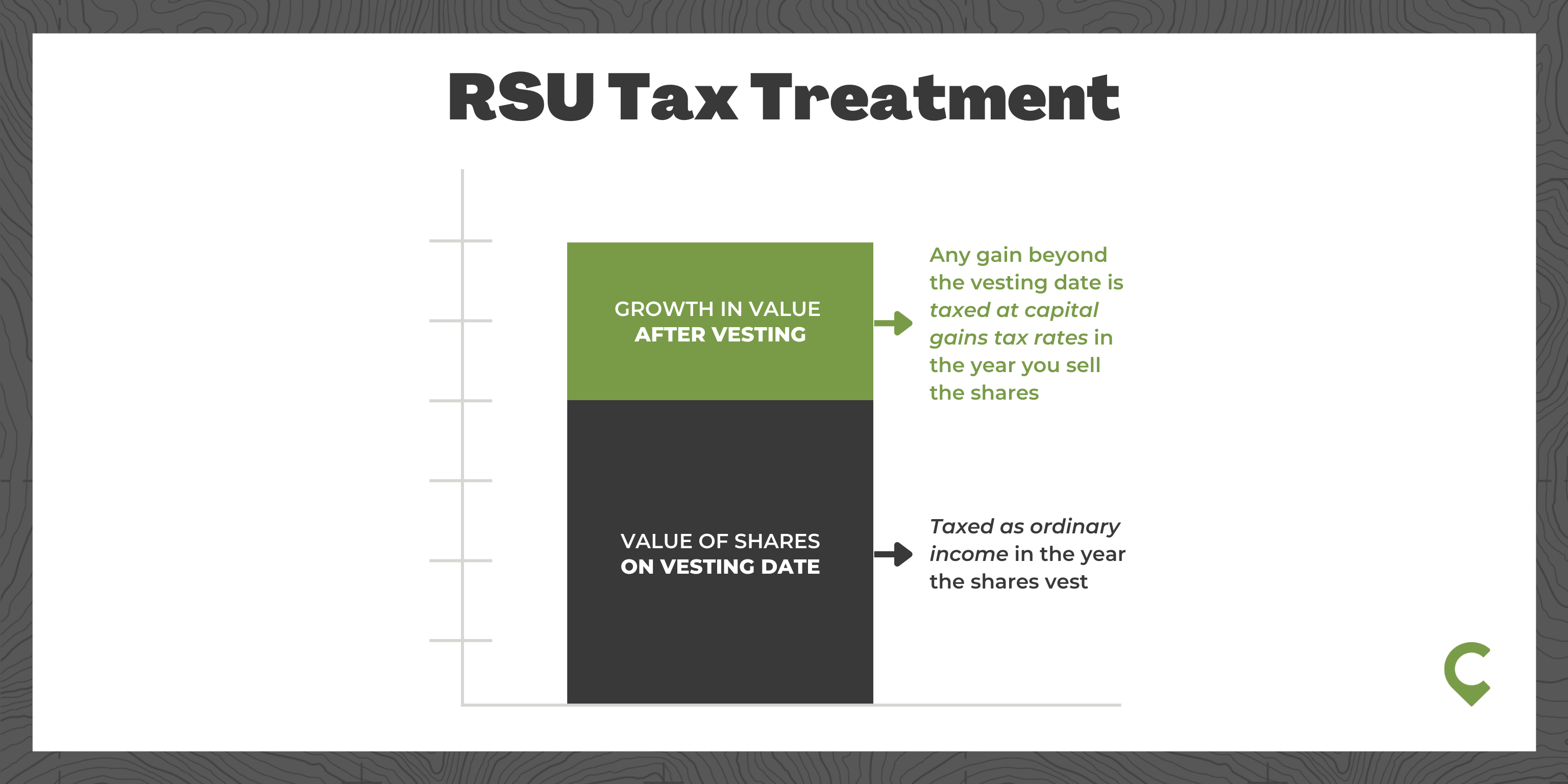

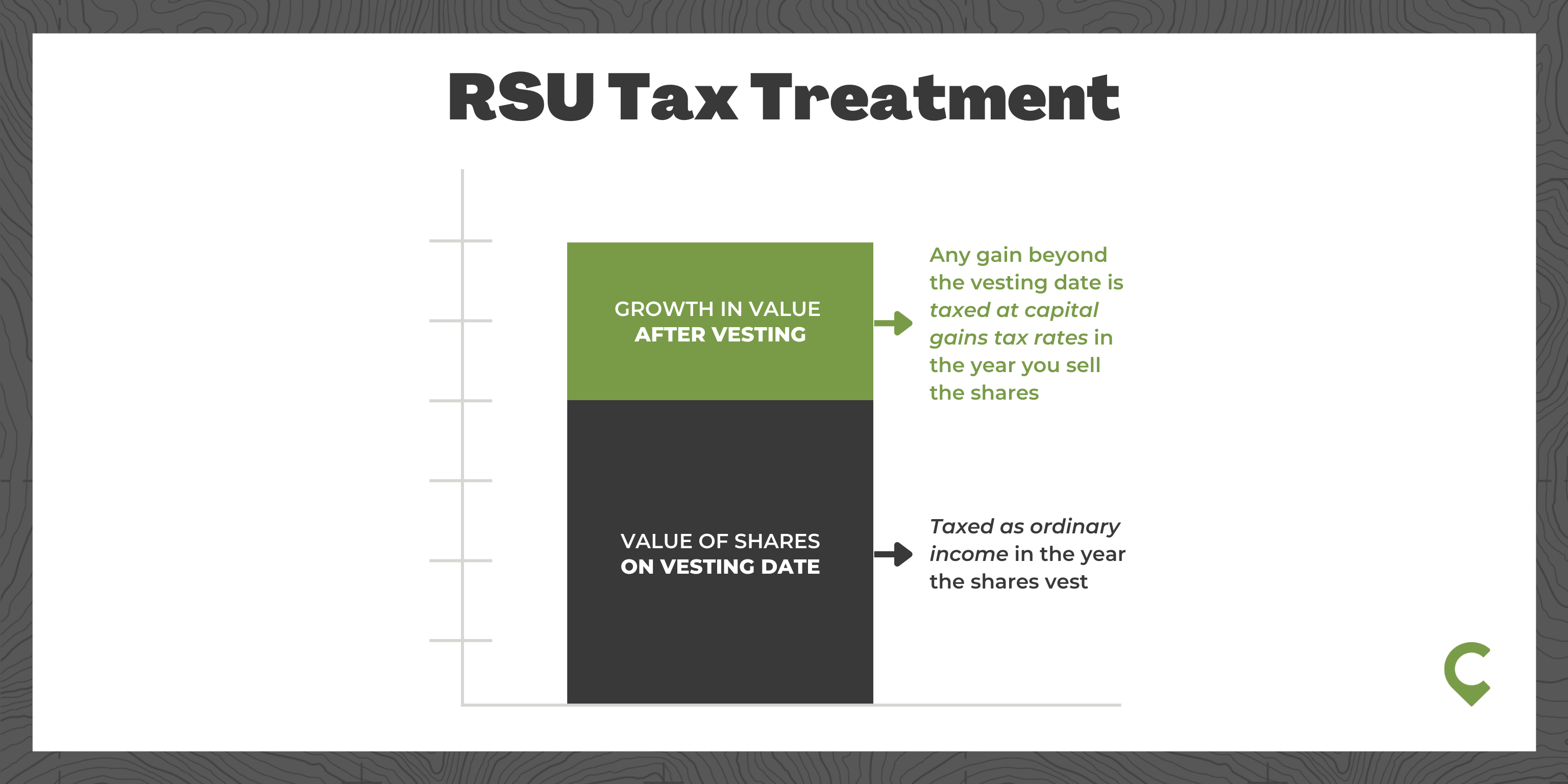

Rsu Taxes Explained 4 Tax Strategies For 2022

How Do Taxes Affect Income Inequality Tax Policy Center

9 Expat Friendly Countries With No Capital Gains Taxes

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Difference Between Income Tax And Capital Gains Tax Difference Between

What Is Capital Gains Tax Www Qredible Co Uk Bina Haber

Capital Gains Tax Cgt Calculator For Australian Investors

What Are Capital Gains Tax Rates In Uk Taxscouts

Understanding Capital Gains Tax In Planning Your Estate Trust Will